Funding Today

Growing Everday

Flexible funding solutions tailored for your business

growth - we're always ready to listen, support, and provide the funding you

need to move forward.

Can I Have Money is a financial technology company, not a

bank.

2550+ organizations trusted Can I have money

10+

$800M+

$1.2B+

12000+

Financial options you need to grow your

business

Can I Have Money is the only partner

you need for business growth. With flexible lending, and credit solutions,

everything you need to manage and expand your business is easily accessible from

one powerful platform.

Working Capital

Term Loans

SBA Loans

Line of Credit

Real Estate

Credit Repair

CIHM OVERVIEW

The Financing You Need

To Grow Your Business.

From Financing To Strategy – Can I Have Money

Provides All-in-One Solutions To Take Your Business To The Next Level

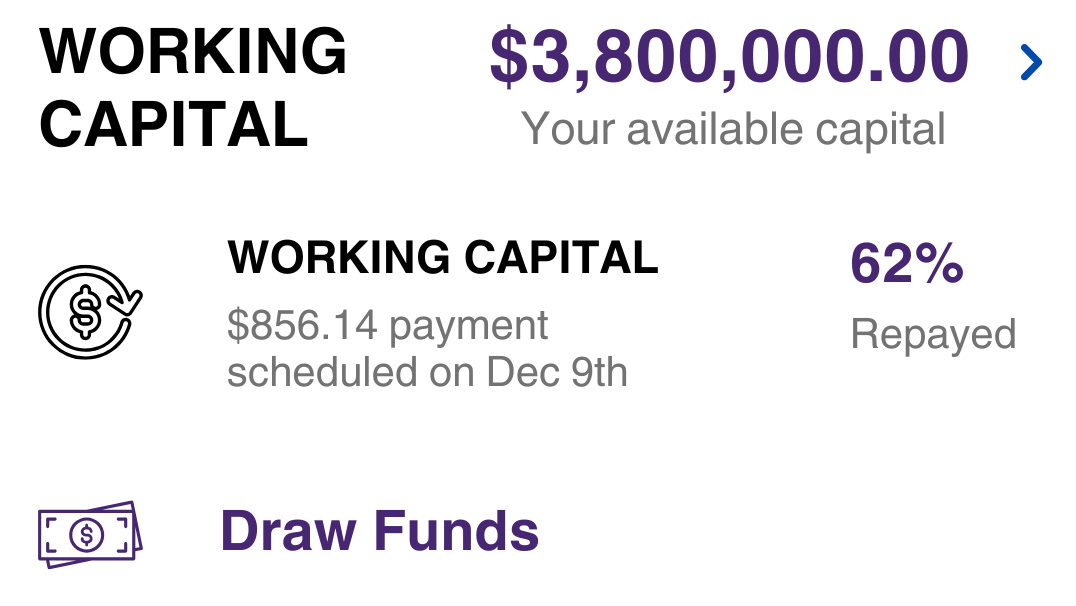

Working capital that powers your business.

Take advantage of competitive rates and

tailored solutions to cover day-to-day operations and fuel your

growth.

Affordable rates that make managing cash flow stress-free and cost-effective.

Get funds quickly with our streamlined process, to keep your

business going.

Choose repayment terms that align perfectly with your revenue cycle for ease and flexibility.

Access the capital you need to scale, manage expenses, and seize new opportunities.

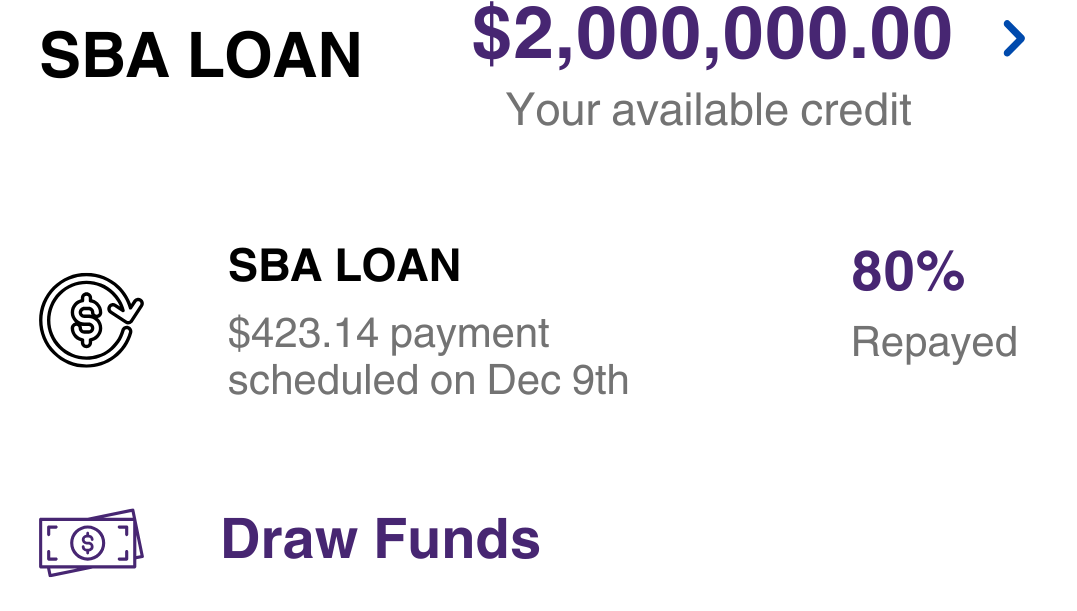

SBA loans designed to build your future.

Unlock long-term, low-interest funding

to grow your business and achieve your big-picture goals.

Take advantage of some of the lowest rates in the market, designed to support sustainable growth.

Benefit from extended repayment periods to keep your monthly payments manageable.

Access significant capital to expand operations, purchase equipment, or invest in your business’s future.

Enjoy peace of mind with loans supported by the Small Business Administration, offering added security and stability.

A line of credit that adapts to your needs.

Flexible financing at your

fingertips—borrow what you need, when you need it, and pay for

what you use.

Access competitive rates designed to keep your financing affordable and efficient.

Reuse your credit as you repay, ensuring funds are always available when opportunities arise.

No hidden fees—pay interest only on the amount you borrow, giving you full control over your finances.

Secure the capital you need to manage cash flow, inventory, or unexpected expenses.

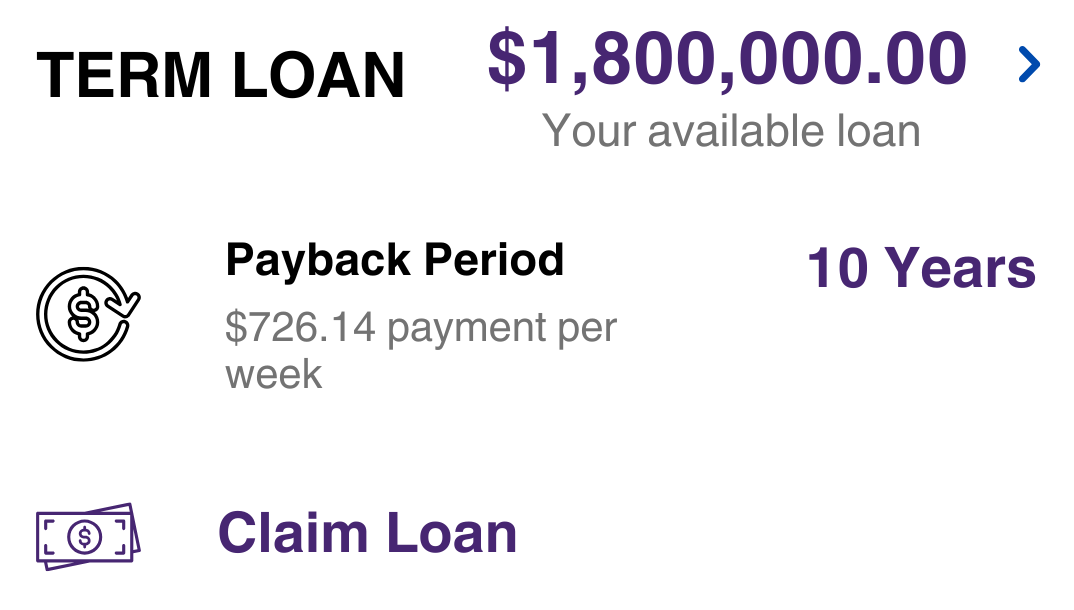

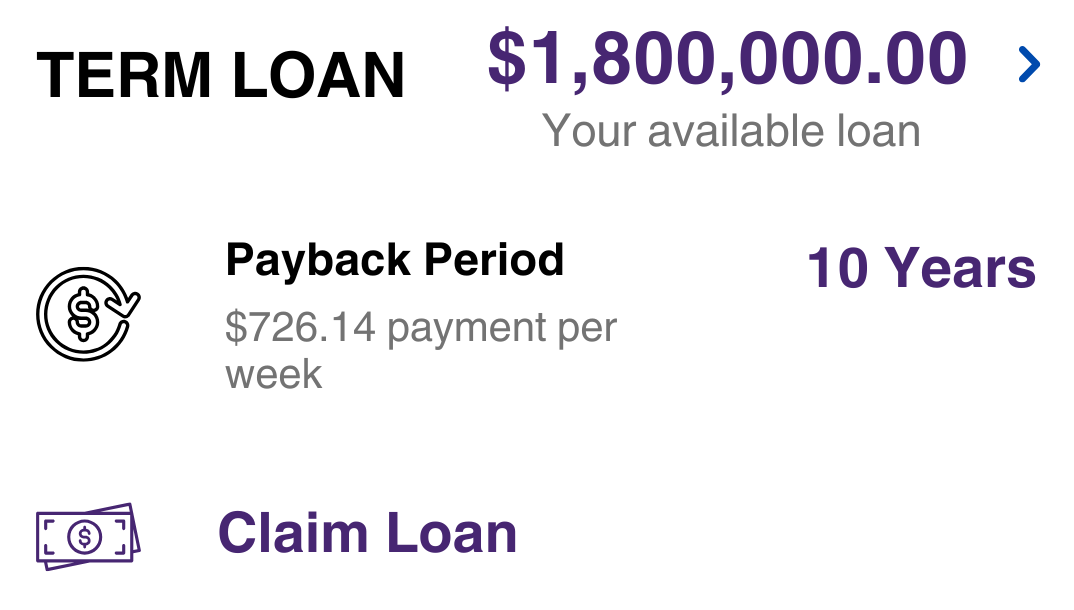

Term loans that fuel your growth.

Get the funding you need upfront, with

predictable payments and terms that suit your business.

Lock in competitive rates to fund your goals without breaking the bank.

Secure the capital you need for expansion, equipment, or major investments.

Plan with confidence using clear repayment schedules and consistent monthly payments.

Move quickly on opportunities with a streamlined application process and rapid funding.

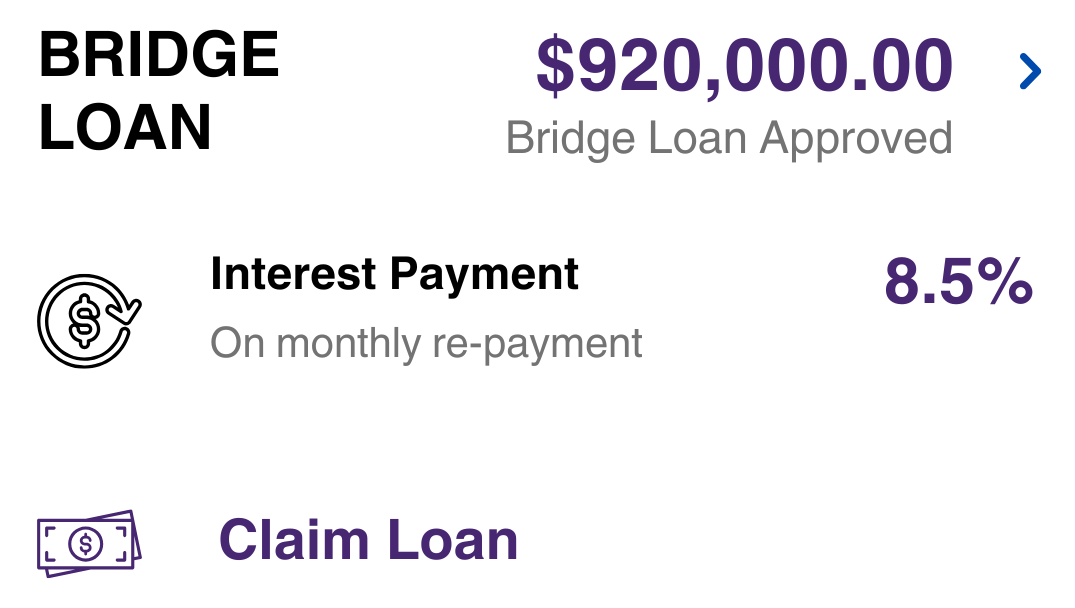

Bridge loans to keep your business moving.

Short-term financing to cover gaps and

seize opportunities while waiting for long-term funding.

Affordable rates to help you manage cash flow during transitions or unexpected delays.

Get the capital you need to cover payroll, inventory, or

operational expenses.

Flexible short-term solutions designed to bridge financial gaps with ease.

Access funds fast to ensure your business stays on track, no matter the challenge.

Looking For Real Estate Loans?

Explore flexible financing options designed to

help you secure, build, or expand your real estate investments with ease.

Real Estate Loans: Build Your Business on

Solid Ground

Investing in real estate requires capital—and

we’re here to make it simple. Our Real Estate Loans offer

flexible funding solutions for acquisitions, renovations, or expansions to

help your business thrive.

Starting at 6.5% APR, we make real estate investments affordable.

Secure the capital needed for property purchases, renovations, or

expansion projects.

Enjoy long-term repayment options tailored to your business needs.

Get fast approvals and funding to capitalize on opportunities quickly.

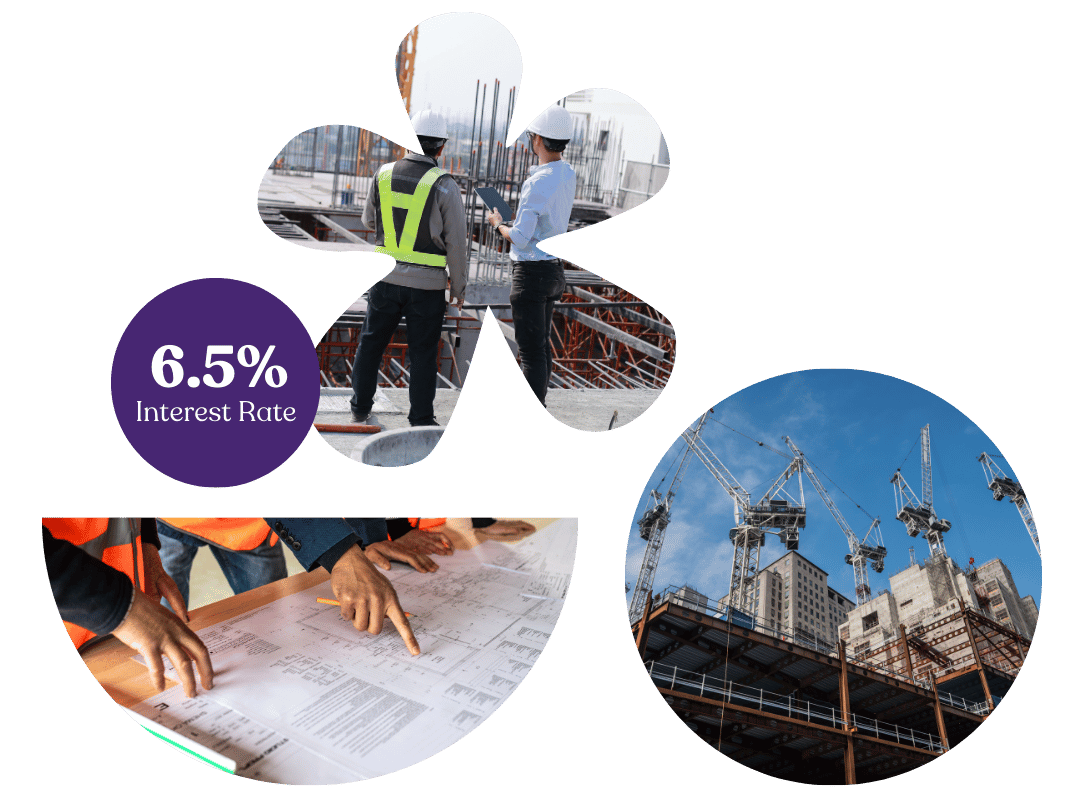

Ground-Up Construction Loans

Whether you’re developing a new commercial property or

residential project, our Ground-Up Construction Loans provide

the funding and flexibility you need to bring your plans to life.

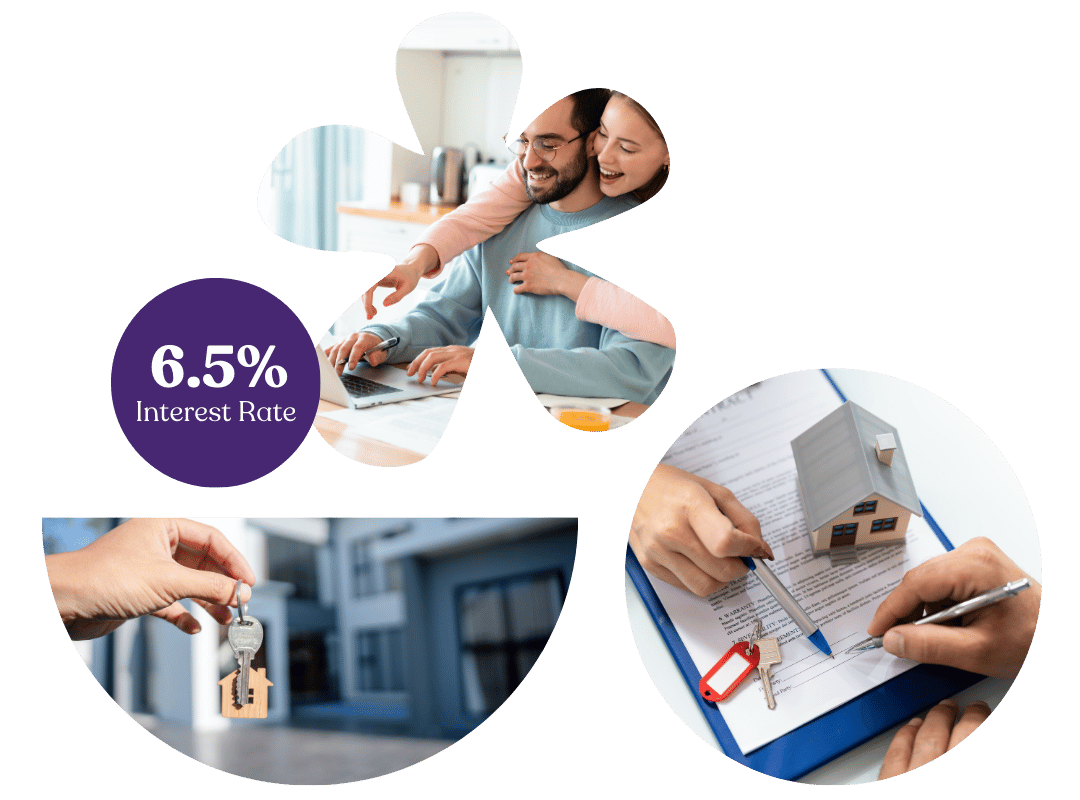

Mortgage Refinancing

Lower your interest rates, reduce monthly payments, or

access cash from your home’s equity with our Mortgage Refinance

—designed to give you greater control over your finances.

Industries We Serve

We understand that each industry has its

own challenges and opportunities, so we provide customized programs designed

specifically for your business type

Credit Repair

Don’t let a low credit score hold you

back. With our expert credit repair services, you can take control of

your financial future and unlock the opportunities you deserve.

Empowering business to grow

Can I Have Money is more than just a financing

platform—they became a trusted partner in helping us understand and

optimize our business finances. Their team worked closely with us to

analyze our cash flow and identify areas where we could save and invest

more effectively. Thanks to them, we’ve streamlined our operations,

reduced unnecessary expenses, and improved profitability.

12000+

Learn best practices from people operations experts

Finance Blog By CIHM

Resources for small businesses designed to help business owners to understand financing, and growth.